Bill 219, a Private Member’s Bill introduced by MPP Rudy Cuzzetto to modernize Ontario’s Insurance Act, will proceed to public hearings

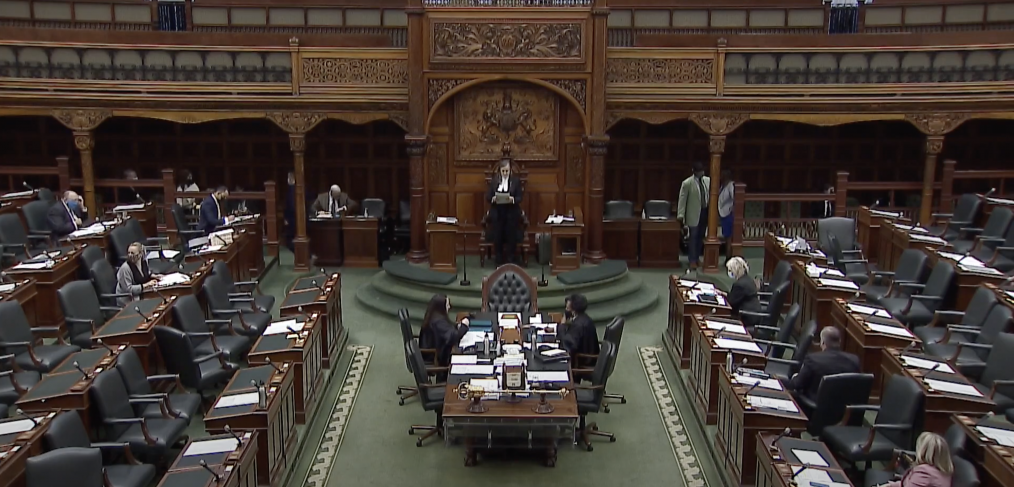

TORONTO – A Private Member’s Bill introduced by Rudy Cuzzetto, MPP for Mississauga–Lakeshore, will proceed to public hearings, as it passed second reading in the Ontario Legislative Assembly today, and was referred to the Standing Committee on Finance and Economic Affairs.

Bill 219, the Life Settlements and Loans Act, would modernize section 115 of the Insurance Act, which was first introduced in 1933. It would create a well-regulated secondary market in life insurance, as already exists in the United States, United Kingdom, Europe, Japan, and in the Province of Quebec.

“I’m very pleased that Bill 219 has passed second reading,” said Cuzzetto. “At a time when many families are struggling due to the ongoing COVID-19 pandemic, this legislation would make important updates to the Insurance Act in order to better meet the needs of Ontario seniors.”

These amendments would provide access to an alternative financial resource, and allow Ontario seniors to access the fair market value of their life insurance policies – potentially tens of millions of dollars more than they now receive, every single year.

In order to ensure consumers are protected, Bill 219 includes a set of common-sense safeguards, including full, true, and plain disclosure requirements, a required 10-day cooling-off period, and the right to consult a financial or legal advisor.

Additionally, the Financial Services Regulatory Authority would be required to provide oversight for these transactions, using well-established international best practices, to protect consumers.

“While consumer protection must be paramount,” said Cuzzetto, “the legitimate need to protect our seniors cannot justify – and in fact, it is undermined by – the monopsony power granted to life insurers by the current section 115, to set the surrender values for their policies.”

According to a study by the London School of Business, secondary markets deliver fair market values over four times higher than the cash surrender values offered by insurers.

“I’m looking forward to public hearings and further consultations on this bill,” said Cuzzetto.

Once a date is set for Bill 219 to be debated at Committee, members of the public will have an opportunity to attend (virtually), and to make presentations on the bill.

Quick Facts

- Bill 219 provides for a 10-day cooling-off period, during which agreements may be cancelled, with no legal or financial penalties. This would give all consumers the opportunity to consult with financial and legal advisors.

- The proposed legislation also includes provisions that would require all agreements to be presented in a manner that ensures full, true, and plain disclosure.

If you would like to make your Views on Life Settlements known we would welcome you to fill out the Survey Below